Fundify.xyz is a fintech organization dedicated to financing various impactful projects. We believe in the power of collaboration and innovation to drive positive change. Here’s a glimpse into some of the initiatives were associated with:

“One Ummah BD” a brand promoting a well-rounded and fulfilling Muslim lifestyle.

“Awratunnisa” champions the cause of stylish yet modest clothing for Muslim women.

“Nevintex” offers cutting-edge digital screen printing and knit garment solutions.

“Asli” focuses on responsible and high-quality milk production for a healthy community.

“Wholesale Line” provides seamless solutions for businesses seeking a hassle-free wholesale experience.

“Digital IT Solution” delivers innovative and reliable IT solutions for the ever-evolving digital landscape.

“Jannater Sathi” facilitates meaningful connections for those seeking a happy and fulfilling marriage.

“Halal Work” connects job seekers with halal and genuine employment opportunities.

“Kom Valley” empowers consumers with a marketplace offering a wide range of products at reasonable prices

Fundify exclusively finances projects that operate within the boundaries of Islamic Shariah principles.

Fundify follows the schemes: Musharaka and Mudaraba. Investors are informed about the risks and decide which scheme to invest in.

Musharaka is an Arabic word that means being a partner or participant. In the context of business and commerce, Musharaka refers to a joint business in which all participants share in the profits and losses of the joint business. Musharaka or participatory business is an ideal alternative arrangement for interest-based financing.Our investors will be mentioned as “Silent Partners”

- Proof of identity: This may include a copy of a valid passport, national identity card, or other government-issued identification.

- Proof of identity for nominee: This may include a copy of a valid passport, national identity card, or other government-issued identification.

- Proof of address: This may include a utility bill, bank statement, or other document that shows the investor’s current address.

- Proof of transaction: This may include any attachment which refers to the transaction made with Fundify.

The investment term length varies based on the specific investment opportunity.

- For “Musharaka” – ranging from 12 months to 60 months even more.

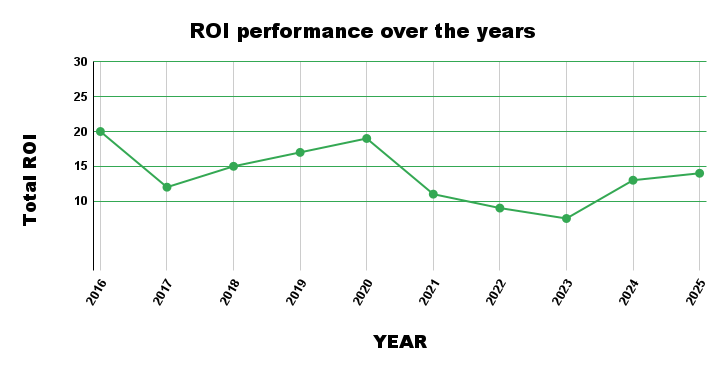

We have achieved an average ROI of 15% and are striving for better business performance

each financial year. At present, our expected ROI (Return on Investment) remains at an estimated

10%, subject to potential fluctuations and improvements.

Our investors will be mentioned as “Silent Partners” and “Fundify” will be

mentioned as the “Working Partner”. According to mutual agreement between the investors

and “Fundify” all projects and business operations will be managed to ensure

financial control and decision-making.